Your Experience

Don’t Make Just Any Decision,

With §1031 exchanges, you have a short period of time to get through a complex process. This can lead to rash decision-making and undue pressure placed on too few properties.

At Mercer, we work with you early to get a strategy in place, so that you are not scrambling later on decisions that matter.

Align, Acquire, Execute

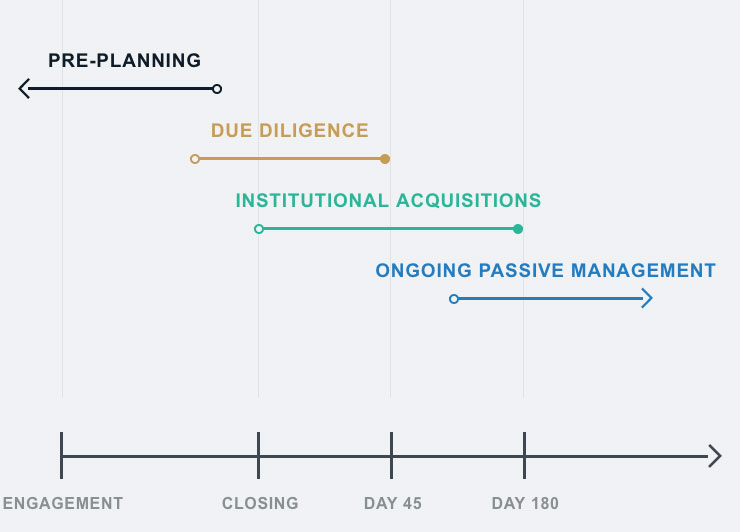

Hit the ground running before the clock starts ticking. We begin the due diligence of acquisition targets months in advance of a typical exchange — and we warehouse acquisition targets to be available to you long after.

By extending the pre-planning period, we’re able to lengthen your typical 45-day property identification window, maximizing flexibility, eliminating variables and reducing risk.

01. Pre-Planning

Debt and ownership restructuring, separation of ownership group, analysis of personal real estate balance sheet, development of disposition strategy and the tying up of all loose ends prior to closing.

02. Due Diligence

Property sourcing, due diligence and financial audits; negotiations with property managers; and off-market sourcing through our network of partners.

03. Institutional Acquisitions

Financial modeling across a diverse range of circumstances; optimizing ownership structures; and maximizing asset type and market diversification.

04. Ongoing Passive Management

Property management (leasing, maintenance); asset management (business plan, administration, accounting); biannual/annual financial reporting; and continuous property updates so that you are set up with a 100% passive experience.